Given that Wipro Ltd.’s American Depository Receipts (ADRs) were up 17% on Friday, investors shouldn’t be shocked by Monday morning’s 13% stock gain at domestic exchanges. Analysts noted that, of the four IT majors, Wipro is the only one whose December quarter statistics showed signs of improvement in discretionary spending. But before becoming overly optimistic about the counter, analysts want to see more.

The stock increased by 13.10 percent on Monday, reaching a peak of Rs 511.95 on the BSE. As a result, the IT subscription has increased by 15% in the past month. In contrast, Tata Consultancy Services Ltd. had a rise of 2%, Infosys Ltd. of 5%, and HCL Technologies Ltd. of 7%.

“Wipro’s Q3 results point to a shift. The first revenue degrowth in the previous four quarters occurred around the top end of the advised band. After three quarters of successively lower bands, the guidance for the upcoming quarter is gradually better. Its consultancy division, CAPCO, had double-digit booking increase. We think it is the first quantifiable indication of a recovery in discretionary spending. Wipro’s recent performance was hampered by CAPCO’s exposure to discretionary finance.

Axis Securities said Wipro has lagged in its execution despite having better results and better deal wins. However, FY25may show some recovery backed by strong deal wins, it said. For lacking the necessary visibility, it recommended a ‘Sell’ rating on the stock.

HDFC Institutional Equities said Wipro’s trajectory is ‘recovering’ after a 6 per cent drop in the quarterly revenue rate over the past three quarters. Despite improved commentary on consulting business, Wipro’s growth markers remain stressed such as deal market-share loss to peers, broad-based decline within verticals and a steep decline in T5 accounts.

Driving growth from its partner ecosystem has been Wipro’s primary focus. The company is also working to improve its operating profile based on modifications to its operating structure, including portfolio focus in APMEA, absorbing growth office functions within Strategic Market Units, developing a delivery cadre, and placing a stronger emphasis on training and development. Maintain REDUCE on Wipro with a target price of Rs 450, based on 17 times FY26E, according to the brokerage.

Wipro recorded a 1.7% sequential decline in constant currency (CC) revenue for the quarter. This was in the range of – 3.5% to minus 1.5%, which was the upper end of their guidance. Analyst estimates of a 2-4% degrowth in sales were surpassed by Wipro’s degrowth.

“This performance has come about despite some low-margin client rationalisation in APMEA (effect not measured). Compared to Street’s worst fears, which were for a “wider and deeper” furlough quarter, the result has been significantly better. The high ADR performance (up 18 per cent on 12th January 2024) is likely because of positioning,” said Nirmal Bang Institutional Equities.

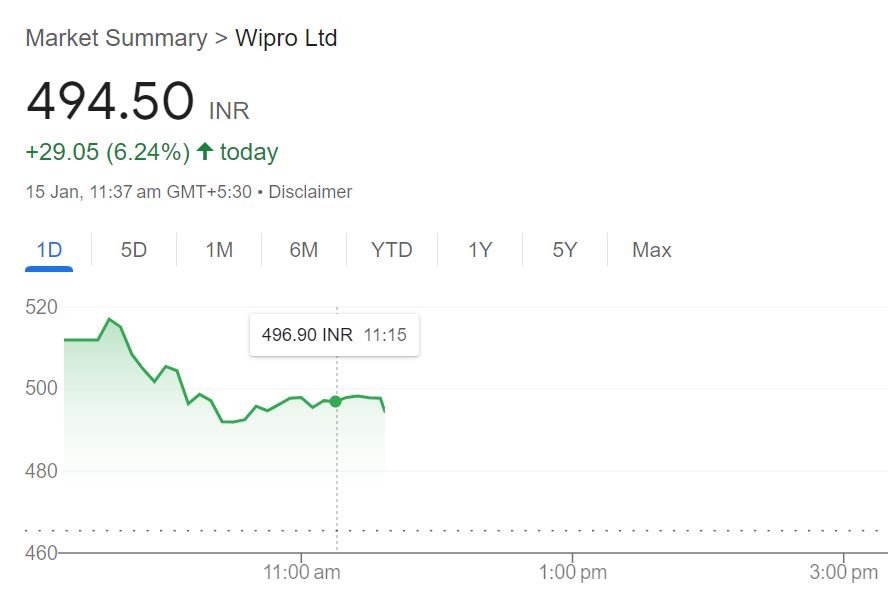

Current Market Price – CMP on 15th Jan 2024.